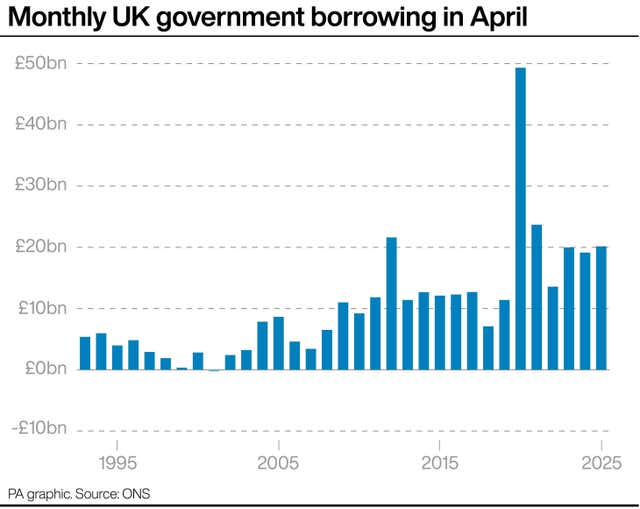

Pressure on Chancellor after Government borrowing jumps to £20.2bn

The Office for National Statistics said public sector net borrowing rose to its fourth-highest April figure on record.

UK Government borrowing rose by more than expected to £20.2 billion last month, mounting further pressure on Chancellor Rachel Reeves to meet her fiscal rules.

The Office for National Statistics (ONS) said public sector net borrowing rose to its fourth-highest April figure on record after increasing £1 billion year-on-year.

The state borrowing figure reflects the difference between Government spending and its income, largely through tax receipts.

The latest figure showed that the Chancellor had to borrow more money than expected over the month, surpassing analyst predictions of £17.6 billion.

It comes as Ms Reeves seeks to meet her fiscal rule of balancing day-to-day spending with revenues by 2029-30, while improving public services and targeting accelerated economic growth.

The rise in borrowing was largely linked to increases in public sector pay, national insurance payments and higher benefits and state pensions.

Central government departmental spending on goods and services rose by £4.2 billion year-on-year to £37.9 billion due to April pay increases and cost inflation.

Meanwhile, social benefits paid by the state rose £1.3 billion to £26.8 billion after inflation-linked rises in many benefits.

Public sector net debt was estimated at 95.5% of UK GDP (gross domestic product) at the end of April 2025, meaning the proportion of debt was 0.7 percentage points higher than a year earlier and remains at levels last seen in the early 1960s.

Deputy director for public sector finances at the ONS Rob Doody said: “At £1 billion higher than the same time last year, this April’s borrowing was the fourth highest for the start of the financial year since monthly records began more than 30 years ago.

“Receipts were up on last April, thanks partly to the higher rate of national insurance contributions.

“However, this was outweighed by greater spending, due to rising public services’ running costs and increases in many benefits and state pensions.”

On Thursday, the ONS also revised down its borrowing figure for the latest fiscal year, to March 2025, by around £3.7 billion to £148.3 billion after receiving more information on tax receipts.

It was still around £11 billion above the forecast set by the Government’s official forecaster, the Office for Budget Responsibility.

Chief secretary to the Treasury Darren Jones said: “After years of economic instability crippling the public purse, we have taken the decisions to stabilise our public finances, which has helped deliver four interest rate cuts since August, cutting the cost of borrowing for businesses and working people.

“We’re fixing the NHS, with three million more appointments to bring waiting lists down, rebuilding Britain with our landmark planning reforms and strengthening our borders, delivering on the priorities of the country through our plan for change.”