UK house price growth accelerates as buyers ‘rushed’ to beat stamp duty rises

Across the country, house prices were higher in February, compared with a year earlier.

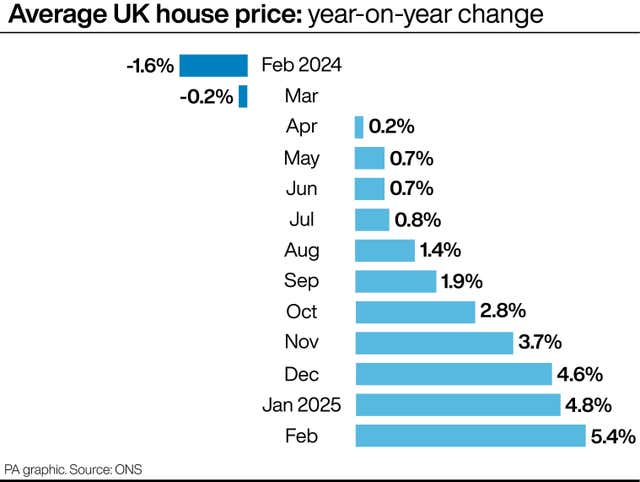

UK house prices jumped by 5.4% in the year to February – the fastest rate in more than two years, new official figures show.

The annual rate increased from 4.8% in the year to January, according to data from the Office for National Statistics.

House price growth has been accelerating since last summer, while activity has picked up as buyers rushed to beat stamp duty increases.

Across the country, house prices were higher in February, compared with a year earlier.

They shot up to £292,000 in England (5.3% annual growth rate), £207,000 in Wales (4.1%), and £186,000 in Scotland (5.7%) in the 12 months to February 2025.

The average house price in Northern Ireland was £183,000 between October and December 2024, surging 9% from the same period a year before.

Within England, the North West had the highest house price inflation over the latest period, at 8% – while London had the weakest at 1.7%,

Experts said there was a rush among home buyers to complete their purchases ahead of stamp duty discounts becoming less generous.

From April, first-time buyers started paying stamp duty on properties costing more than £300,000. They were previously exempt from paying the tax on properties up to £425,000.

Stamp duty applies in England and Northern Ireland.

Santander UK said its data showed house purchases tripled in March, compared with a year ago, as the stamp duty deadline “sparked a new lease of life into the housing market”.

Elliott Jordan-Doak, senior UK economist for Pantheon Macroeconomics, said: “Official house prices will be boosted for at least another two months by the flurry of activity ahead of the stamp duty changes.

“But there is genuine strength in the housing market.”

House price inflation rose to the highest rate since December 2022 in February, “illustrating the resilience of the housing market to a barrage of headwinds in high borrowing costs, easing GDP (gross domestic product) growth, fiscal events, and geopolitical uncertainty”, he said.

Sarah Coles, head of personal finance at Hargreaves Lansdown, agreed that February’s figures showed the “peak of activity, as buyers rushed purchases through the system before the stamp duty holiday ran out at the end of the month”.

Jason Tebb, president of property search portal OnTheMarket, said: “Affordability remains a challenge but with a number of lenders reducing their mortgage pricing over the past few weeks, this may continue to ease if swap rates decline and other lenders follow suit.

“Cheaper mortgage rates would certainly help boost activity and transactions, which are of benefit not just to the housing market but wider economy.”

Swap rates – which are used by lenders to price mortgages – have dipped since US president Donald Trump’s tariffs announcement earlier in April, amid expectations that interest rates will be cut further in the coming months.

Experts said this could feed through into lower mortgage pricing with lenders rolling out cheaper deals.