Historical benchmarks and milestones in Rachel Reeves’ first Budget

Government investment is forecast to reach the highest sustained level since the 1970s.

The first Budget by a Labour chancellor in 14 years, and the first to be delivered by a woman, also signalled some major historical milestones for tax and spending.

Here are some of the key figures and economic benchmarks from Rachel Reeves’ speech, based on forecasts published separately by the Office for Budget Responsibility (OBR).

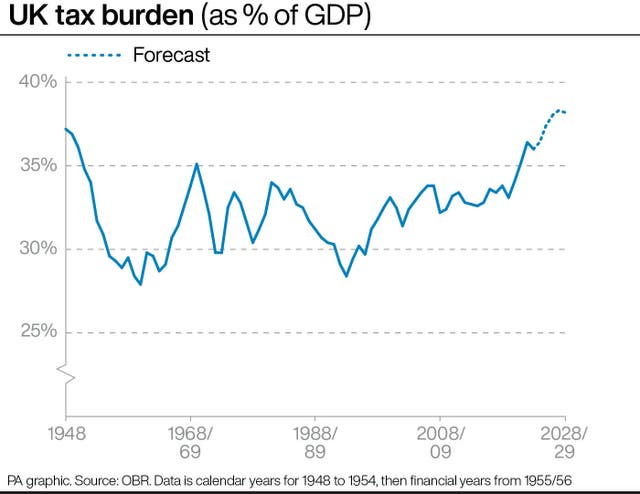

– Tax burden

The overall tax burden in the UK is forecast to rise from the equivalent of 36.4% of GDP (gross domestic product, or the total value of the economy) in 2024/25 to 38.3% in 2027/28: the highest level since records began in 1948.

At the time of the previous Budget in March 2024, the OBR forecast the tax burden would rise only as far as 37.0% by 2027/28, just below the previous record of 37.2% in 1948.

Policy announcements in the latest Budget have resulted in the forecast for 2027/28 being raised by more than one percentage point.

The projected figure of 38.3% in 2027/28 is also more than five percentage points higher than the pre-pandemic level of 33.1% in 2019/20.

The increase is driven “mainly by personal taxes”, including the impact of changes in employer rates of national insurance, and “capital taxes”, reflecting the likely rise in equity and property prices, the OBR said.

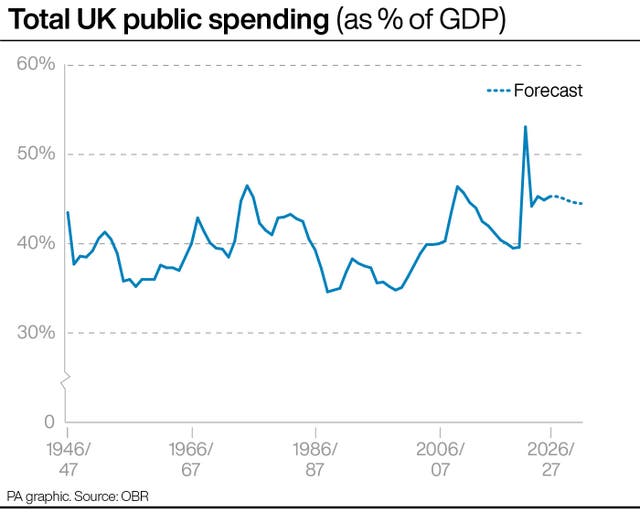

– Total government spending

The size of the UK state, as measured by total government spending, is forecast to remain at the equivalent of between 44% and 45% of GDP until the end of the decade.

This is almost five percentage points higher than before the Covid-19 pandemic.

It also represents the longest sustained period of spending at this level since the Second World War.

The forecast suggests spending will not fall below the equivalent of 44% of GDP for 10 financial years in a row, from 2020/21 to at least 2029/30.

This easily surpasses the two other post-war periods when spending was 44% of GDP or above, in the three years from 1974/75 to 1976/77 and the four years from 2009/10 to 2012/13.

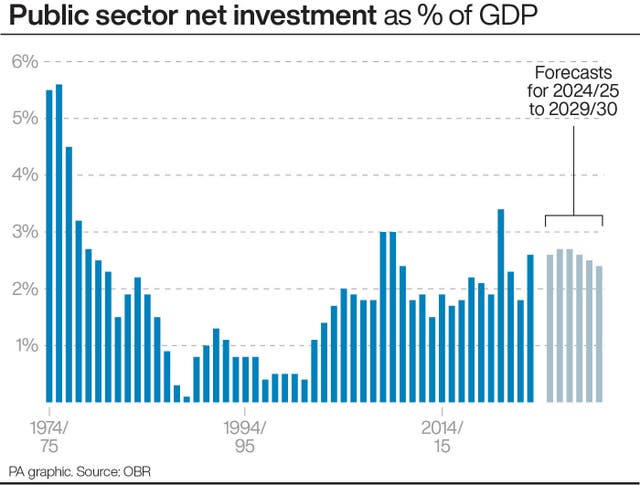

– Government investment

Government investment is forecast to remain above the equivalent of 2% of GDP in every year for the rest of the decade: the highest sustained level since the 1970s.

Public sector net investment stood at the equivalent of 2.6% of GDP in 2023/24 and is forecast to be the same level in 2024/25, climbing to 2.7% in both 2025/26 and 2026/27, before falling slightly in each subsequent year to reach 2.4% by 2029/30.

This would represent seven consecutive years with investment above 2%: a trend not seen in the UK for more than 40 years.

Government investment as a proportion of GDP was above 2% in every year from 1948, when current records begin, to 1980/81.

It then remained below 2% in almost every year until the Covid-19 pandemic, save for 1983/84, 2008/09-2010/11, and 2017/18-2018/19.

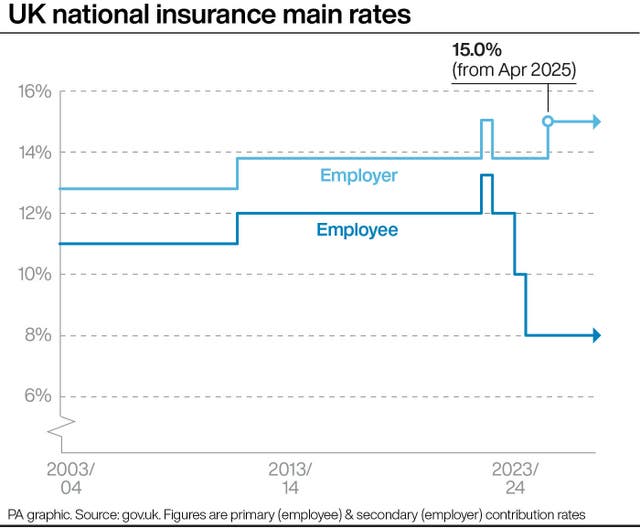

– National insurance

The Government’s decision to raise the main employer contribution rate of national insurance from 13.8% to 15.0% from April 2025 will see this rate of insurance reach its highest sustained level on record.

The increase, combined with a lower threshold at which contributions have to be paid, is forecast to raise £25.7 billion by 2029/30, before allowing for any indirect effects on the economy, the OBR said.

The previous Conservative government increased the rate to the slightly higher level of 15.05% in April 2022, but returned it to 13.8% a few months later in November.

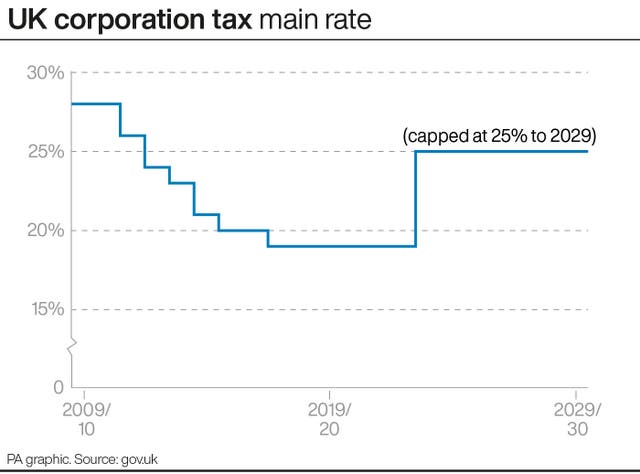

– Corporation tax

The Government has committed to keeping the main rate of corporation tax, for companies with profits over £250,000, at 25% for the length of this parliament.

The amount of money this will raise for the government is estimated to be the equivalent of around 3.5 of GDP from 2024/25 onwards.

This would be the highest level since the introduction of corporation tax in 1965, according to the OBR.