Hospitality industry bosses welcome job saving measures in 'mini-budget'

Tax cuts and support measures aimed at boosting trade in restaurants and attractions hit by the coronavirus pandemic have been welcomed by bosses in the hospitality industry.

Chancellor Rishi Sunak announced a major new package of support for the struggling hospitality and tourism sectors in his mini-Budget, including an unprecedented government-backed discount for eating out.

Today's announcement: Key Points

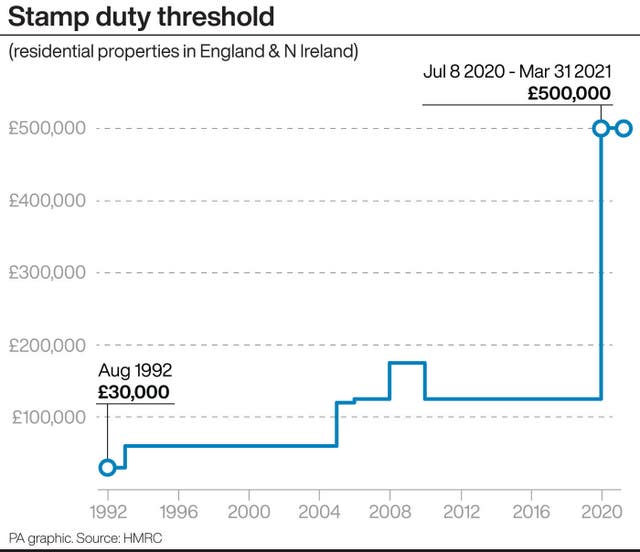

Plan confirmed to abolish stamp duty on properties up to £500,000 in England and Northern Ireland under a temporary measure lasting until March 31 2021.

An “eat out to help out” plan for dining out in August to boost the hospitality sector, with a 50% discount per head from Monday to Wednesday up to a maximum discount of £10 per diner.

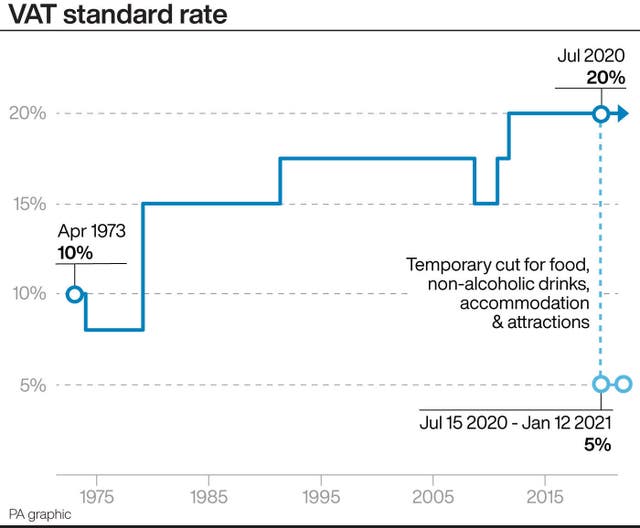

VAT slashed on food, accommodation and attractions from 20% to 5% from July 15 until January 12, a tax cut worth up to £4 billion.

Scheme for firms to be given £2,000 for each new apprentice they hire under the age of 25 and a new bonus of £1,500 for apprentices over that age.

VAT will be slashed for all food outlets, accommodation businesses and public attractions from 20 per to five per for six months, cutting the tax bill for 150,000 businesses by £4bn.

The Government also launched a voucher scheme giving 50 per cent discounts on all meals eaten out from Monday to Wednesday, up to a value of £10 per person.

Jon Stevens, tax partner at global legal business DWF, said the VAT cut was long overdue and would increase public spending.

“The hospitality sector has long campaigned for a reduced rate of VAT and it is a shame that it has taken the economic damage of Covid-19 to produce a temporary tax cut,” he said.

“However, businesses in the restaurant and hospitality sectors will welcome the reduction in VAT that will hopefully encourage people to spend money with them while we recover from lockdown.”

Clive Wratten, CEO of the Business Travel Association (BTA), said the announcement would give “a limited kickstart” to the travel industry.

“We welcome the support for returning employees to work and the VAT reduction for UK accommodation,” he added. “Public confidence will be buoyed by discounted eat-outs in August, allowing for trust in the safety of business travel to grow.”

Black Country Living Museum chief operating officer Natasha Eden said that as a charity it did not charge VAT on admissions, the tax reduction would not help there.

She added: "The bit we would like to understand more detail around is food and drink.

"We hope we will meet the criteria for the reduction to five per cent on that when we get a little bit more detail." The museum in Dudley will be offering 'food to go' when it reopens on August 1.

In his statement Mr Sunak also unveiled a £2bn “kickstart scheme” to create jobs and training opportunities for young people.

The boss of one of the Midlands biggest training groups today called on him to ensure the job creation and retention schemes are able to work together seamlessly.

Chris Luty, chief executive officer of BCTG Group, said the Chancellor’s announcements were “very positive” but that they needed to be aligned for maximum impact.

“The kickstart scheme and the focus on traineeships are very encouraging but we need to ensure that young workers can progress from traineeships into apprenticeships so that at the end of six months they are fully employed and not simply back to square one,” he said.

Meanwhile housing industry bosses described a move to slash stamp duty for home buyers as a “shot in the arm” that would “stoke the fires” of homebuyer demand.

Research by Barrows and Forrester said the move could save homebuyers up to £961 in the Black Country and £2,800 in Staffordshire.

More analysis:

Managing Director James Forrester, said: “The only criticism is that the Government has once again focussed on fuelling demand rather than addressing the more pressing issue of housing supply.

“While this will help boost house prices, it will do little to address the supply and demand imbalance and the problem of affordability that many are already facing.”

Dudley Building Society’s chief executive, Jeremy Wood, said the stamp duty cut would help "stimulate the market, assist buyers of all types and go some way to cutting the costs of downsizing for many older homeowners".

"The effect will also cause a ripple effect and benefit ancillary services, such as property conversion, renovations and DIY as well as help estate agents retain and recruit staff," he added.

Jarna Rahman, from law firm FBC Manby Bowdler, said the stamp duty holiday would mean a much needed boost for the residential property market.

"The announcement means that nearly nine out of 10 people will pay no stamp duty at all between now and March 31 2021," she said.

"It is a welcome move by the Government and will help the wider economic recovery."

West Midlands Mayor Andy Street said the package of measures was a "good immediate response" to the situation and would help to "get people spending".

"We need to encourage spending and the cuts to VAT and stamp duty are a good way to do that," he said.

WATCH: Andy Street gives his reaction on Sky News

The Mayor added that the furlough bonus and the cash boost for firms who take on trainees would be key factors in the region's efforts to avoid mass unemployment.

Sir John Peace, chairman of the Midlands Engine, said: "From the commitment to finding, creating and protecting jobs through to the measures that will enable the levelling up of our economy – with the significant investment that will entail – this was a statement I believe we can and must all get behind.

"The collective package of measures announced will undoubtedly provide vital support for our region’s people, businesses and communities."

Maria Machancoses, director of sub-national transport body Midlands Connect, said the region needed to see more emphasis on infrastructure if it is to quickly "rebound and recover" from the impact of Covid-19

"By accelerating the development and delivery of long-term projects such as HS2 and Midlands Engine Rail, the Government can create high-value jobs and stimulate sustained investment and regeneration over the next decade," she said. "This certainty and commitment is what businesses need."

The TUC said that far more needed to be done to protect the country from mass unemployment.

General Secretary Frances O’Grady, said: “The Chancellor should have announced targeted support for the hardest-hit sectors like manufacturing and aviation.

“Struggling businesses will need more than a one-off job retention bonus to survive and save jobs in the long-term."